What is a Minimum Credit Limit?

Nicole Madison

Nicole Madison

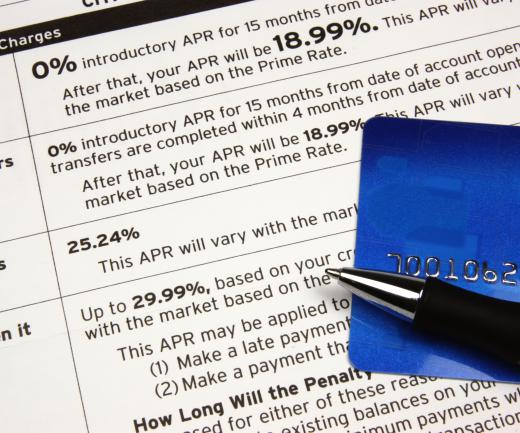

The term minimum credit limit is often used in relation to credit card accounts. When a person is approved for a credit card, the credit card company typically applies a limit to the amount he can charge using the card. Often, however, a credit card company has a range of credit limits it will offer to cardholders, and the minimum credit limit is the lowest limit it will offer to new credit card applicants. In most cases, individuals with the lowest credit scores are given credit limits that are closer to the minimum, while those with better credit scores may enjoy higher limits. While a person may start out with the minimum credit limit, he may not necessarily keep that limit for the entire time he has the card; credit card companies often offer credit limit increases.

In many cases, a person who wants to apply for a credit card considers the credit card company’s minimum and maximum credit limits. For example, a credit card company may advertise a minimum credit limit of $300 US Dollars (USD) and a maximum limit of $3,000 USD. This basically means a person who is approved for a credit card from this company will have a credit limit of at least $300 USD but not more than $3,000 USD.

Usually, credit card applicants have no way of knowing how much their credit limits will be before they apply for a credit card. Most credit card companies decide how much credit they will provide after checking an applicant's credit score. A credit card company typically uses an applicant’s credit score, as well as other information the applicant provides, to decide whether the applicant represents a high lending risk or a low risk. An individual who has a poor credit history is typically a high risk and will likely receive a limit that is close to the company’s minimum. On the other hand, a person with a high credit score could possibly receive the maximum credit limit, or close to it.

Most credit card companies provide opportunities for credit card holders to increase their credit limits. Even a person who starts out with the minimum credit limit may enjoy an automatic credit limit increase after he has proven himself responsible by making payments on time. Others may call their credit card companies to request increases after they’ve kept up with the payments for a significant period of time.

AS FEATURED ON:

AS FEATURED ON:

Discussion Comments

@browncoat - The whole point of a credit card, from the company's view, is for you to spend more on it, so they can charge you more fees and interest.

And the interest rates are often really big. Even the best credit cards are usually around 15% interest.

On the other hand you need a credit card so you can show that you are a responsible person and build up a good credit rating. I've known some people who managed to get an $8000 limit and immediately began spending on it. Money they would never be able to afford to pay back even without the enormous interest charges.

It's much safer to keep to the minimum credit card limit.

I try to keep my credit limit as low as possible. I only have a credit card so I can make purchases online, or sometimes there are other occasions it is good to have one.

But I know that I could take it too much for granted. And really, I keep it close to empty, just paying the minimum payments when I have to.

I'm worried if I increase the limit, I will spend too much on it.

Post your comments